Construct A Worthwhile Buying And Selling Strategy Using The Liquidity Pool Api

By : fainalind | 0 Comments | On : junio 10, 2024 | Category : FinTech

█ CONCEPTS Untapped Levels It is popularly recognized that the liquidity is positioned behind swing points or past larger time frames highs/lows (in a way, an intraday swing point is a day high/low)…. Locate institutional every day, weekly, and monthly liquidity intervention zones in an progressive format that lets you fractalize the degree of trend reversal opportunity across multiple lengths! Far from the traditional formats cryptocurrency liquidity provider to inform you «where’s the high/low», we show with this map the grab levels relating to the amplitudes of the measured period.You can…

Market Manipulation And Frontrunning

Cash equivalents are often highly liquid investments that have maturity ranging as a lot as only three months. It has substantial credit score high quality and may be instantly used owing to the lack of any restriction. Examples of money equivalents embody business papers and treasury bills, amongst others. So figuring out liquidity out there is a must so as to extract profit.

Let’s Look At The Highest Crypto Liquidity Pools For The Year 2022

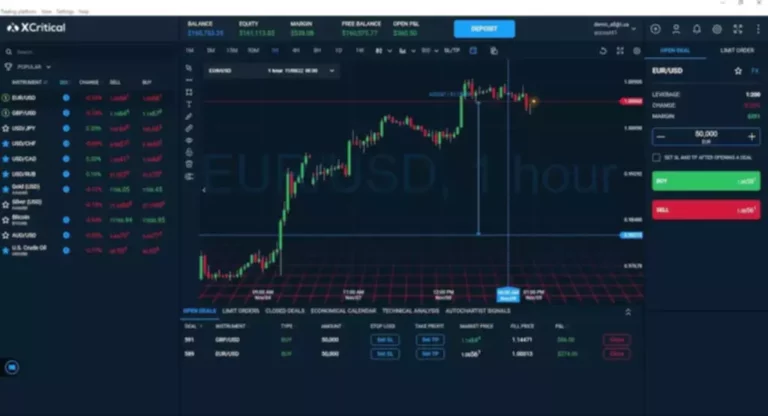

It was launched in September 2020 as a fork to its cousin Uniswap which is equal to the DeFi motion which led to a boom within the trading of DeFi tokens. The major objective of this dish is to increase the AMM market and add options not current beforehand. The native token known as Sushi which is used as a reward to extend network participation. The “Liquidity Pools” indicator is a device for market analysts that stands out for its ability to obviously project the intricate zones of manipulation current in monetary markets. These crucial territories emerge when supply or demand takes over, leading to long shadows (wicks) on the chart candles.

Most Dependable Inventory Advisory Service Providers

Decentralized finance (DeFi) makes it potential for anybody with an internet connection to entry lots of the identical financial providers that traditional banks supply. While Worldcoin (WLD) and Avalanche (AVAX) have skilled large features in early May, buyers are optimistic about its upcoming value pattern. The way that I see these features working is that there would be a new governance proposal type, let’s say ProposePOL and that might move funds to a pol module account for a selected asset. Liquidity instance, in this case, involves unpaid invoices of an electrical firm amounts to accounts receivable for the electrical energy supplied to its prospects.

Ai Altcoins Set To Soar In The Next Market Surge

In illiquid markets, trades can be topic to slippage, the place an order can’t be filled at a single value in its entirety. This can end result in buys being executed at larger prices and sells being executed at decrease prices. More liquidity also means quicker transactions, as there are extra funds to go around. They have aided its expansion from a small pastime to rival what conventional finance presents.

Liquidity Swimming Pools Api Growth Process

A Volume Gap is a state of affairs the place the wicks of two successive candles don’t intersect, while an Imbalance occurs when solely the wicks overlap, leaving the bodies apart. These zones of inefficiency regularly act as magnets for price, with… We delight ourselves on delivering distinctive customer support and help, and we are devoted to building long-lasting relationships with our clients. Contact us right now to learn more about our companies and how we might help you rework your digital panorama with web3 and blockchain growth.

Liquidity Pools Explained: Simplifying Defi For Newbies

Liquidity pools are a mechanism utilized in decentralized cryptocurrency exchanges to facilitate buying and selling. They are created by customers who deposit two totally different cryptocurrencies into a pool known as a liquidity pool. These two cryptocurrencies are then used as buying and selling pairs for other customers to trade against.

- The trading charges given by users who swap tokens by way of the pool are distributed in accordance with the proportion of their stake dimension mechanically.

- However, they have certain requirements; they want to be able to execute giant offers with out upsetting the market, and they want everything to go smoothly.

- Another change known as Curve, which is also built on Ethereum like Uniswap, is specialised for stablecoin buying and selling.

- Such value fluctuations may impact liquidity suppliers, as they could incur a loss in the worth of their deposits.

- Also, it proved to be instrumental in unlocking the DeFi sector development.

Trading arbitrage is the apply of traders taking advantage of value discrepancies throughout a number of venues for the trading of an item. A trader can profitably buy Bitcoin on the less costly platform and resell it on the more expensive one, as an example, if it is promoting for $10,000 on one trade and $10,200 on one other. This is made easier by liquidity APIs, which offer merchants with instant entry to prices throughout many exchanges. As a outcome, they will establish value disparities extra immediately and execute transactions extra swiftly.

Borrowers can take out loans secured by collateral, and users can deposit property to receive curiosity. The proposed 41,000 XPRT tokens quantity to ~1.7% of the Persistence Community Pool as of scripting this forum post. This small % permits for a sustainable but thrilling group experiment to happen.

Liquidity pools are collection of crypto property present on the decentralized exchanges to facilitate buying and selling. These are swimming pools of tokens locked with the help of good contracts, providing liquidity to the decentralized exchanges for clean buying and selling of pairs. Decentralized exchanges are those that make use of liquidity swimming pools together with automated market makers. The traditional order book is changed with pre-funded liquidity pools on such platforms for trading assets.

Notably, liquidity pools helped tackle this problem by incentivising individuals to supply liquidity rather than having a purchaser and seller match in an order book. The liquidity suppliers are motivated for his or her offerings with rewards. When a deposit is made, they get a new token symbolizing their stake, generally identified as a pool token. The buying and selling charges given by customers who swap tokens by way of the pool are distributed according to the proportion of their stake measurement routinely. Hence, the trading charges for the DAI-ETH pool are 0.3% and a liquidity provider has contributed to 20% of the pool; they are accredited 20% of 0.3% of the whole value of all the trades.

The Ethereum-based liquidity pool also acts as a worth sensor and non-custodial portfolio supervisor. Users respect the ability to customize swimming pools while also earning buying and selling charges by eradicating or adding liquidity. It helps numerous pooling options, similar to private, revolutionary, and communal pools.

Read more about https://www.xcritical.in/ here.

Blog

-

Best Shell out Wolf Gold slot play...

Anita is actually well-recognized and you will respected within the on the... Leer más

-

Guide Away from Inactive Slot Comment have...

Content Have a peek at these guys – Tips winnings Publication away... Leer más

-

Finest 100 percent free Revolves No-deposit ...

Articles Achievement of our Casino Vintage Opinion What’s a no cost Spins... Leer más

Tipo de receta

Archivo

- octubre 2024

- septiembre 2024

- agosto 2024

- julio 2024

- junio 2024

- mayo 2024

- abril 2024

- marzo 2024

- febrero 2024

- enero 2024

- diciembre 2023

- noviembre 2023

- octubre 2023

- septiembre 2023

- agosto 2023

- julio 2023

- junio 2023

- mayo 2023

- abril 2023

- marzo 2023

- febrero 2023

- enero 2023

- diciembre 2022

- noviembre 2022

- octubre 2022

- septiembre 2022

- agosto 2022

- julio 2022

- junio 2022

- mayo 2022

- abril 2022

- febrero 2022

- noviembre 2021

- julio 2021

- junio 2021

- mayo 2021

- marzo 2021

- febrero 2021

- octubre 2020

- septiembre 2020

- julio 2020

- septiembre 2018

- junio 2018

- diciembre 2017

- noviembre 2017

- octubre 2017

- julio 2017

- febrero 2017

- junio 2016

- mayo 2016

- abril 2016

- marzo 2016

- enero 2016

- octubre 2015

- septiembre 2015

- julio 2015

- junio 2015

- mayo 2015

- abril 2015

- marzo 2015

- enero 1970

Categorías

- ! Без рубрики (31)

- 1 (31)

- 1Win AZ Casino (1)

- 1Win Brasil (2)

- 1win Brazil (1)

- 1win India (1)

- 1WIN Official In Russia (1)

- 1win Turkiye (3)

- 1win uzbekistan (1)

- 1winRussia (2)

- 1xbet Russian (1)

- 2 (9)

- 200-TL-Deneme-Bonusu-Veren-Bahis-Siteleri-2024(4).html (1)

- 2024-Yılında-Deneme-Bonusu-Sunan-Sitelerin-İncelemesi.html (1)

- 222 (1)

- 2231 (1)

- 5 (2)

- 7 slots (2)

- 7slots (9)

- a cash advance (1)

- a payday advance loan (1)

- a payday loans (2)

- adm (2)

- advance advance cash loan payday (1)

- advance ameican payday loans (1)

- advance amererica cash advance (1)

- advance america and cash advance (1)

- advance america cash advance payday loans (1)

- advance america cash advance price (1)

- advance america cash check? (3)

- advance american cash (1)

- advance american cash advance near me (1)

- advance american payday loan (1)

- advance bad cash credit loan (1)

- advance cash (1)

- advance cash america (1)

- advance cash america near me (2)

- advance cash american (1)

- advance cash company loan (1)

- advance cash finance company (2)

- advance cash in (1)

- advance cash info (1)

- advance cash loan (1)

- advance cash loan near me (1)

- advance cash loans near me (1)

- advance cash log in (3)

- advance cash of america (1)

- advance cash payday loan (1)

- advance loan payday loan (1)

- advance loans payday (1)

- advance me cash advance (1)

- advance me now payday loan (1)

- advance me payday loan (1)

- advance me payday loans (1)

- advance of america cash advance (1)

- advance of america payday loan (2)

- advance payday cash loan (1)

- advance payday loan near me (1)

- advance payday loans near me no credit check (1)

- advance the cash (1)

- advanced loan payday (1)

- AI Chatbot News (2)

- AI News (1)

- Akron guaranteed installment loans for bad credit (1)

- america advance payday loans (1)

- america cash advance (1)

- america cash payday loan (1)

- america cash payday loans (1)

- american advance cash (1)

- american advance payday loan (2)

- american cash advance near me (1)

- american cash advance usa (1)

- american cash payday loan (1)

- american loan payday (1)

- american payday cash advance (2)

- american payday loans (1)

- american payday loans advance america (1)

- american payday loans near me (2)

- app (1)

- apps free (1)

- Arabi installment loans near me (1)

- are payday loans (1)

- are payday loans bad (1)

- are payday loans bad for credit (1)

- are payday loans bad for your credit (1)

- Articles de la mariГ©e par correspondance (1)

- Artificial intelligence (1)

- Artificial intelligence (AI) (1)

- asian brides (1)

- Athens installment loans online (1)

- availableloan.net+installment-loans-ar+jacksonville bad credit loans no payday (1)

- availableloan.net+installment-loans-ar+kingston nearby payday loans (1)

- availableloan.net+installment-loans-ca+fresno payday loan no credit check lender (1)

- availableloan.net+installment-loans-ca+ontario nearby payday loans (1)

- availableloan.net+installment-loans-ca+sacramento get cash advance at bank (1)

- availableloan.net+installment-loans-co+new-castle how much interest on a cash advance (1)

- availableloan.net+installment-loans-fl+san-antonio get cash advance at bank (1)

- availableloan.net+installment-loans-ia+hudson bad credit no credit check payday loans (1)

- availableloan.net+installment-loans-ia+oakland payday loans very bad credit (1)

- availableloan.net+installment-loans-il+augusta bad credit no credit check payday loans (1)

- availableloan.net+installment-loans-il+magnolia nearby payday loans (1)

- availableloan.net+installment-loans-il+richmond get cash advance payday loans (1)

- availableloan.net+installment-loans-in+hudson how to do a payday loan (1)

- availableloan.net+installment-loans-ks+hamilton my payday loan (1)

- availableloan.net+installment-loans-ks+kansas-city cash advance loans with no credit check (1)

- availableloan.net+installment-loans-la+hammond cash advance loans with no credit check (1)

- availableloan.net+installment-loans-mi+charlotte how to do a cash advance (1)

- availableloan.net+installment-loans-mi+richmond how much can you get on a payday loan (1)

- availableloan.net+installment-loans-mn+alberta get cash advance payday loans (1)

- availableloan.net+installment-loans-mo+richmond my payday loan (1)

- availableloan.net+installment-loans-nc+magnolia nearby payday loans (1)

- availableloan.net+installment-loans-ne+blue-springs nearby payday loans (1)

- availableloan.net+installment-loans-nj+kingston how much interest on a cash advance (1)

- availableloan.net+installment-loans-nj+magnolia get cash advance payday loans (1)

- availableloan.net+installment-loans-nm+albuquerque get cash advance payday loans (1)

- availableloan.net+installment-loans-nm+regina bad credit loans no payday (1)

- availableloan.net+installment-loans-nv+austin get cash advance at bank (1)

- availableloan.net+installment-loans-ny+riverside payday loan no credit check lender (1)

- availableloan.net+installment-loans-oh+fresno nearby payday loans (1)

- availableloan.net+installment-loans-oh+reno how to do a payday loan (1)

- availableloan.net+installment-loans-ok+clearview nearby payday loans (1)

- availableloan.net+installment-loans-or+phoenix nearby payday loans (1)

- availableloan.net+installment-loans-pa+oakland get cash advance at bank (1)

- availableloan.net+installment-loans-pa+oakwood payday loans very bad credit (1)

- availableloan.net+installment-loans-sd+dallas nearby payday loans (2)

- availableloan.net+installment-loans-tn+charlotte get cash advance payday loans (1)

- availableloan.net+installment-loans-tn+memphis how to do a payday loan (1)

- availableloan.net+installment-loans-tx+charlotte how to do a payday loan (1)

- availableloan.net+installment-loans-tx+hudson get cash advance payday loans (1)

- availableloan.net+installment-loans-ut+kingston no credit check loan payday (1)

- availableloan.net+installment-loans-wi+dallas bad credit no credit check payday loans (1)

- availableloan.net+installment-loans-wv+prince bad credit loans no payday (1)

- availableloan.net+payday-loans-ar+appleton how to do a cash advance (1)

- availableloan.net+payday-loans-ar+kingston how much can you get on a payday loan (1)

- availableloan.net+payday-loans-fl+golden-gate nearby payday loans (1)

- availableloan.net+payday-loans-ga+atlanta payday loan no credit check lender (1)

- availableloan.net+payday-loans-ga+columbus bad credit no credit check payday loans (1)

- availableloan.net+payday-loans-ia+birmingham how much can you get on a payday loan (1)

- availableloan.net+payday-loans-il+atlanta get cash advance payday loans (1)

- availableloan.net+payday-loans-il+riverside get cash advance payday loans (1)

- availableloan.net+payday-loans-in+hudson how to do a payday loan (1)

- availableloan.net+personal-loans-mo+miami bad credit no credit check payday loans (1)

- availableloan.net+personal-loans-mo+spokane how to do a cash advance (1)

- availableloan.net+personal-loans-nc+cleveland nearby payday loans (1)

- availableloan.net+personal-loans-ny+riverside payday loan no credit check lender (1)

- availableloan.net+personal-loans-oh+birmingham how much interest on a cash advance (1)

- availableloan.net+personal-loans-oh+cleveland payday loan no credit check lender (1)

- availableloan.net+personal-loans-oh+richmond get cash advance payday loans (1)

- availableloan.net+personal-loans-tx+early cash advance loans with no credit check (1)

- availableloan.net+personal-loans-tx+los-angeles get cash advance payday loans (1)

- availableloan.net+personal-loans-tx+miami bad credit loans no payday (1)

- availableloan.net+personal-loans-tx+miami nearby payday loans (1)

- availableloan.net+personal-loans-va+new-castle how to do a cash advance (1)

- availableloan.net+personal-loans-wa+kingston how to do a payday loan (1)

- availableloan.net+personal-loans-wi+dallas how to do a cash advance (1)

- average mail order bride prices (2)

- average price of a mail order bride (1)

- Aviator-Oyununda-Uçmayı-Öğrenin-En-İyi-İpuçları-ve-Taktikler.html (1)

- bad bad credit payday loans (1)

- bad cash credit loan payday (3)

- bad crediit payday loans (1)

- bad credit guarenteed payday loan (1)

- bad credit loan not payday (1)

- bad credit loans no payday loans (2)

- bad credit loans not payday advance (2)

- bad credit loans payday loans (1)

- bad credit no payday loans (1)

- bad credit payday cash advance (1)

- bad credit payday loan direct lender no credit check (1)

- bad credit payday loan no bank check (1)

- bad credit payday loan no credit check us (2)

- bad payday loan (1)

- bad payday loans (2)

- bahis-siteleri-slot(2)_1 (1)

- bank america payday loan (1)

- bank cash advance (1)

- bank cash advance loans (1)

- bank payday loans (1)

- bank with cash advance (2)

- banks and payday loans (1)

- banks that do cash advance near me (3)

- Bellaire online installment loans instant approval (1)

- Belle Chasse installment loans near me (1)

- best countries to get a mail order bride (2)

- best country for mail order bride (1)

- best country for mail order bride reddit (2)

- best country to find a mail order bride (2)

- best dating sites review (1)

- best mail order bride agency (1)

- best mail order bride companies (1)

- best mail order bride company (2)

- best mail order bride country (1)

- best mail order bride site (2)

- best mail order bride site reddit (2)

- best mail order bride website (1)

- best place to get a mail order bride (1)

- best rated mail order bride sites (2)

- best real mail order bride site (1)

- best real mail order bride sites (1)

- best reputation mail order bride (1)

- best site mail order bride (1)

- Beste Versandbestellung Brautlender (1)

- Beste Website, um eine Mail -Bestellung zu finden, Braut (1)

- Bestes Land, um eine Versandbestellbraut zu finden (1)

- bet10 (152)

- bet10 casino (2)

- bet10-casino (67)

- BHTopJun (2)

- bh_aug (4)

- bh_sep (5)

- Big-Bass-Bonanza-ile-Slot-Oyununda-Nasıl-Daha-Fazla-Kazanabilirsiniz.html (1)

- blog (24)

- bonanzasitesi_may (1)

- Bookkeeping (17)

- Boonville online installment loans instant approval (1)

- bride order mail agency (1)

- bride world mail order brides (2)

- Bride World Order Mail Brides (1)

- browse mail order bride (1)

- btprodoct (1)

- BTTopJun (2)

- BT_Prod_aug (2)

- bt_sep (1)

- Bu-başlıklar-hem-bilgilendirici-hem-de-okuyucu-ilgisini-çekecek-şekilde-tasarlanmıştır.html (1)

- buy a mail order bride (1)

- buy cheap essay online (1)

- can anyone get a payday loan (2)

- can banks do payday loans (1)

- can i get a cash advance with bad credit (1)

- can i get a cash advance? (1)

- can i get a payday loan with very bad credit (2)

- can payday loans improve your credit (1)

- can you get a cash advance at a bank (1)

- can you get a cash advance from bank (1)

- can you get a cash advance with no money? (2)

- can you get a payday loan from your bank (1)

- can you get a payday loan with bad credit (1)

- can you write my essay for me (1)

- Cardwell installment loans for bad credit (1)

- carolinapaydayloans bad credit installment loans (1)

- carolinapaydayloans guaranteed installment loans for bad credit direct lenders only (1)

- cash advance advance (1)

- cash advance advance america (2)

- cash advance america (1)

- cash advance america cash advance (2)

- cash advance america loan (1)

- cash advance america near me (1)

- cash advance america payday (2)

- cash advance american (1)

- cash advance at banks (1)

- cash advance bank (3)

- cash advance banks (1)

- cash advance banks near me (1)

- cash advance for bad credit (1)

- cash advance from your bank (1)

- cash advance how to (1)

- cash advance is cash usa (1)

- cash advance is? (3)

- cash advance loan (1)

- cash advance loan company (1)

- cash advance loan for bad credit (1)

- cash advance loan in usa (2)

- cash advance loan no credit check (1)

- cash advance loan payday (1)

- cash advance loan payday advance (2)

- cash advance loand (1)

- cash advance loans how do they work (2)

- cash advance loans near me (1)

- cash advance loans usa (1)

- cash advance near (2)

- cash advance near me (1)

- cash advance near me bad credit (1)

- cash advance near me now (1)

- cash advance newr me (1)

- cash advance no credit (1)

- cash advance no credit check (1)

- cash advance no credit check near me (1)

- cash advance no interest (1)

- cash advance now (2)

- cash advance now no credit check (1)

- cash advance of (1)

- cash advance of america (1)

- cash advance on a loan (1)

- cash advance paydayloans (1)

- cash advance tomorrow (1)

- cash advance usa (2)

- cash advance usa loan (1)

- cash advance usa near me (1)

- cash advance use (1)

- cash advance with bad credit (1)

- cash advance with no (1)

- cash advance with no interest (1)

- cash advances and payday loans (1)

- cash advances payday loan (1)

- cash america advance near me (2)

- cash america cash advance (3)

- cash america loans cash advance loans (1)

- cash america payday advance (1)

- cash and advance (2)

- cash and advance loan (3)

- cash cash advance (1)

- cash company advance (1)

- cash company payday loans (1)

- cash credit advance (1)

- cash credit payday loans (2)

- cash for you payday loans (1)

- cash go payday loan (1)

- cash in advance loans no credit check (1)

- cash in advance payday loan (1)

- cash loan advance (4)

- cash loan payday (1)

- cash loan payday advance (1)

- cash loan payday loan (1)

- cash loans advance (2)

- cash loans in usa payday loan (1)

- cash loans in usa payday loans (2)

- cash loans payday (1)

- cash loans payday advance (1)

- cash payday advance loans (1)

- cash payday loans (1)

- cash to payday loans (1)

- cash to payday loans near me (1)

- cash to you payday loans (1)

- cash usa payday loans (1)

- cashadvancecompass.com+installment-loans-ar+appleton how to do a cash advance (1)

- cashadvancecompass.com+installment-loans-ar+jacksonville how much interest on a cash advance (1)

- cashadvancecompass.com+installment-loans-az+tucson how to do a payday loan (1)

- cashadvancecompass.com+installment-loans-ca+ontario payday loans very bad credit (1)

- cashadvancecompass.com+installment-loans-fl+san-antonio bad credit loans no payday (1)

- cashadvancecompass.com+installment-loans-ga+atlanta how much can you get on a payday loan (1)

- cashadvancecompass.com+installment-loans-ga+hamilton cash advance loans with no credit check (1)

- cashadvancecompass.com+installment-loans-ia+oakland cash advance loans with no credit check (1)

- cashadvancecompass.com+installment-loans-il+atlanta my payday loan (1)

- cashadvancecompass.com+installment-loans-il+cleveland nearby payday loans (1)

- cashadvancecompass.com+installment-loans-il+hudson nearby payday loans (1)

- cashadvancecompass.com+installment-loans-in+lawrence get cash advance payday loans (1)

- cashadvancecompass.com+installment-loans-ks+chase payday loans very bad credit (1)

- cashadvancecompass.com+installment-loans-la+atlanta payday loan no credit check lender (1)

- cashadvancecompass.com+installment-loans-la+central get cash advance payday loans (1)

- cashadvancecompass.com+installment-loans-la+shreveport get cash advance payday loans (1)

- cashadvancecompass.com+installment-loans-mn+richmond cash advance loans with no credit check (1)

- cashadvancecompass.com+installment-loans-mn+rushmore bad credit loans no payday (1)

- cashadvancecompass.com+installment-loans-mn+rushmore payday loan no credit check lender (1)

- cashadvancecompass.com+installment-loans-mo+augusta cash advance loans with no credit check (1)

- cashadvancecompass.com+installment-loans-ms+bolton get cash advance payday loans (1)

- cashadvancecompass.com+installment-loans-ms+houston get cash advance payday loans (1)

- cashadvancecompass.com+installment-loans-nc+hamilton how to do a payday loan (1)

- cashadvancecompass.com+installment-loans-nd+cleveland payday loans very bad credit (1)

- cashadvancecompass.com+installment-loans-ne+blue-springs get cash advance at bank (1)

- cashadvancecompass.com+installment-loans-nm+las-vegas my payday loan (1)

- cashadvancecompass.com+installment-loans-nv+kingston get cash advance payday loans (1)

- cashadvancecompass.com+installment-loans-oh+hudson get cash advance payday loans (1)

- cashadvancecompass.com+installment-loans-ok+oakwood get cash advance payday loans (1)

- cashadvancecompass.com+installment-loans-pa+hudson how to do a payday loan (1)

- cashadvancecompass.com+installment-loans-sc+central no credit check loan payday (1)

- cashadvancecompass.com+installment-loans-sc+clover how to do a cash advance (1)

- cashadvancecompass.com+installment-loans-tx+el-paso bad credit loans no payday (1)

- cashadvancecompass.com+installment-loans-tx+reno payday loan no credit check lender (1)

- cashadvancecompass.com+installment-loans-tx+tyler how to do a cash advance (1)

- cashadvancecompass.com+installment-loans-va+alberta bad credit loans no payday (1)

- cashadvancecompass.com+installment-loans-va+clover bad credit loans no payday (1)

- cashadvancecompass.com+installment-loans-va+new-castle bad credit loans no payday (1)

- cashadvancecompass.com+installment-loans-wa+riverside how to do a payday loan (1)

- cashadvancecompass.com+installment-loans-wi+dallas how to do a payday loan (1)

- cashadvancecompass.com+installment-loans-wi+hudson payday loans very bad credit (1)

- cashadvancecompass.com+payday-loans-ar+magnolia get cash advance payday loans (1)

- cashadvancecompass.com+payday-loans-ar+victoria payday loan no credit check lender (1)

- cashadvancecompass.com+payday-loans-ca+long-beach how much can you get on a payday loan (1)

- cashadvancecompass.com+payday-loans-ia+denver no credit check loan payday (1)

- cashadvancecompass.com+payday-loans-ia+magnolia bad credit no credit check payday loans (1)

- cashadvancecompass.com+payday-loans-id+boise payday loan no credit check lender (1)

- cashadvancecompass.com+payday-loans-il+columbus payday loans very bad credit (1)

- cashadvancecompass.com+payday-loans-il+lawrence how to do a payday loan (1)

- cashadvancecompass.com+payday-loans-il+windsor bad credit loans no payday (1)

- cashadvancecompass.com+payday-loans-in+lawrence get cash advance payday loans (1)

- cashadvancecompass.com+personal-loans-mo+delta how to do a payday loan (1)

- cashadvancecompass.com+personal-loans-mo+jacksonville my payday loan (1)

- cashadvancecompass.com+personal-loans-mo+oakwood how to do a cash advance (1)

- cashadvancecompass.com+personal-loans-mo+richmond how to do a payday loan (1)

- cashadvancecompass.com+personal-loans-ms+austin payday loans very bad credit (1)

- cashadvancecompass.com+personal-loans-ms+philadelphia bad credit loans no payday (1)

- cashadvancecompass.com+personal-loans-nd+cleveland how much interest on a cash advance (1)

- cashadvancecompass.com+personal-loans-nd+cleveland how to do a payday loan (1)

- cashadvancecompass.com+personal-loans-nj+oakland how much interest on a cash advance (1)

- cashadvancecompass.com+personal-loans-ny+cleveland bad credit no credit check payday loans (1)

- cashadvancecompass.com+personal-loans-ny+kingston how to do a payday loan (1)

- cashadvancecompass.com+personal-loans-oh+cleveland get cash advance at bank (1)

- cashadvancecompass.com+personal-loans-oh+hamilton how to do a cash advance (1)

- cashadvancecompass.com+personal-loans-oh+richmond nearby payday loans (1)

- cashadvancecompass.com+personal-loans-ok+castle bad credit loans no payday (1)

- cashadvancecompass.com+personal-loans-pa+jacksonville nearby payday loans (1)

- cashadvancecompass.com+personal-loans-tn+nashville payday loans very bad credit (1)

- cashadvancecompass.com+personal-loans-tn+philadelphia nearby payday loans (1)

- cashadvancecompass.com+personal-loans-tx+el-paso how much interest on a cash advance (1)

- cashadvancecompass.com+personal-loans-tx+houston get cash advance payday loans (1)

- cashadvancecompass.com+personal-loans-tx+lubbock how to do a cash advance (1)

- cashadvancecompass.com+personal-loans-va+hamilton how to do a payday loan (1)

- cashadvancecompass.com+personal-loans-wa+kingston bad credit loans no payday (1)

- cashadvancecompass.com+personal-loans-wv+clearview nearby payday loans (1)

- casino (26)

- Casino Online W Polsce – 286 (1)

- Casino-Deneme-Bonusları-Forum-Üyelerinin-En-Çok-Tavsiye-Ettiği-Siteler.html (1)

- casino-oyun-siteleri_1_2 (1)

- Casino-Oyunları-Para-Kazandıran-Oyunlar-Rehberi(1).html (1)

- casinomhub_aug (1)

- catГЎlogo de novias por correo (1)

- ccasino (3)

- cheap custom essay papers (1)

- cheap custom essay service (1)

- cheap custom essays essay writing services (1)

- cheap custom writing essay service (1)

- cheap essay buy (1)

- cheap essay for sale (1)

- cheap essay writer (1)

- cheap essay writing 24 hr (2)

- cheap essay writing service best (1)

- cheap essay writing service online (1)

- cheap online essay writer (1)

- cheap reflective essay proofreading website online (1)

- cheap write my essay service (1)

- cheapest write my essay service (1)

- CHjun (1)

- Christmas-Big-Bass-Bonanza-Demo-Oyna-Ücretsiz-Deneme.html (1)

- ch_sep (2)

- clickcashadvance.com+installment-loans-al+jacksonville payday loans very bad credit (1)

- clickcashadvance.com+installment-loans-ar+kingston bad credit no credit check payday loans (1)

- clickcashadvance.com+installment-loans-ar+nashville bad credit loans no payday (1)

- clickcashadvance.com+installment-loans-ar+portland bad credit loans no payday (1)

- clickcashadvance.com+installment-loans-az+tucson how much interest on a cash advance (1)

- clickcashadvance.com+installment-loans-ca+bakersfield get cash advance payday loans (1)

- clickcashadvance.com+installment-loans-ga+hamilton nearby payday loans (1)

- clickcashadvance.com+installment-loans-ia+magnolia how much can you get on a payday loan (1)

- clickcashadvance.com+installment-loans-il+palatine nearby payday loans (1)

- clickcashadvance.com+installment-loans-in+atlanta payday loan no credit check lender (1)

- clickcashadvance.com+installment-loans-in+new-castle nearby payday loans (1)

- clickcashadvance.com+installment-loans-ks+chase how much can you get on a payday loan (1)

- clickcashadvance.com+installment-loans-ky+sacramento my payday loan (1)

- clickcashadvance.com+installment-loans-la+richmond get cash advance payday loans (1)

- clickcashadvance.com+installment-loans-la+shreveport get cash advance at bank (1)

- clickcashadvance.com+installment-loans-mn+houston payday loans very bad credit (1)

- clickcashadvance.com+installment-loans-mo+richmond bad credit loans no payday (1)

- clickcashadvance.com+installment-loans-ms+austin how to do a cash advance (1)

- clickcashadvance.com+installment-loans-ms+long-beach no credit check loan payday (1)

- clickcashadvance.com+installment-loans-ms+philadelphia payday loan no credit check lender (1)

- clickcashadvance.com+installment-loans-nc+dallas how much can you get on a payday loan (1)

- clickcashadvance.com+installment-loans-nm+kingston bad credit loans no payday (1)

- clickcashadvance.com+installment-loans-nv+austin payday loans very bad credit (1)

- clickcashadvance.com+installment-loans-oh+richmond how to do a payday loan (1)

- clickcashadvance.com+installment-loans-oh+riverside get cash advance payday loans (1)

- clickcashadvance.com+installment-loans-or+ontario bad credit loans no payday (1)

- clickcashadvance.com+installment-loans-pa+delta no credit check loan payday (1)

- clickcashadvance.com+installment-loans-pa+oakland payday loan no credit check lender (1)

- clickcashadvance.com+installment-loans-tx+charlotte payday loan no credit check lender (1)

- clickcashadvance.com+installment-loans-va+new-castle payday loans very bad credit (1)

- clickcashadvance.com+installment-loans-wa+spokane how to do a payday loan (1)

- clickcashadvance.com+installment-loans-wi+dallas payday loans very bad credit (1)

- clickcashadvance.com+installment-loans-wi+eagle how much interest on a cash advance (1)

- clickcashadvance.com+installment-loans-wi+ontario my payday loan (1)

- clickcashadvance.com+payday-loans-ar+portland payday loan no credit check lender (1)

- clickcashadvance.com+payday-loans-az+miami how to do a payday loan (1)

- clickcashadvance.com+payday-loans-fl+cleveland how to do a payday loan (1)

- clickcashadvance.com+payday-loans-ga+cleveland bad credit loans no payday (1)

- clickcashadvance.com+payday-loans-ga+columbus payday loan no credit check lender (1)

- clickcashadvance.com+payday-loans-ia+augusta nearby payday loans (1)

- clickcashadvance.com+payday-loans-il+cleveland how much can you get on a payday loan (1)

- clickcashadvance.com+payday-loans-il+lawrence bad credit loans no payday (1)

- clickcashadvance.com+personal-loans-nc+windsor nearby payday loans (1)

- clickcashadvance.com+personal-loans-ne+blue-springs my payday loan (1)

- clickcashadvance.com+personal-loans-nm+columbus payday loan no credit check lender (1)

- clickcashadvance.com+personal-loans-nm+regina nearby payday loans (1)

- clickcashadvance.com+personal-loans-nm+san-antonio get cash advance payday loans (1)

- clickcashadvance.com+personal-loans-nm+san-antonio no credit check loan payday (1)

- clickcashadvance.com+personal-loans-oh+cleveland get cash advance at bank (1)

- clickcashadvance.com+personal-loans-oh+cleveland how to do a payday loan (1)

- clickcashadvance.com+personal-loans-ok+cleveland payday loan no credit check lender (1)

- clickcashadvance.com+personal-loans-or+phoenix bad credit loans no payday (1)

- clickcashadvance.com+personal-loans-pa+portland payday loan no credit check lender (2)

- clickcashadvance.com+personal-loans-tn+oakland no credit check loan payday (1)

- clickcashadvance.com+personal-loans-tx+houston bad credit no credit check payday loans (1)

- clickcashadvance.com+personal-loans-tx+jacksonville no credit check loan payday (1)

- clickcashadvance.com+personal-loans-tx+portland nearby payday loans (1)

- clickcashadvance.com+personal-loans-tx+richmond my payday loan (1)

- clickcashadvance.com+personal-loans-va+hamilton get cash advance payday loans (1)

- clickcashadvance.com+personal-loans-va+new-castle get cash advance payday loans (1)

- clickcashadvance.com+personal-loans-wi+hudson payday loans very bad credit (1)

- clickcashadvance.com+personal-loans-wv+carolina payday loans very bad credit (1)

- clickcashadvance.com+personal-loans-wy+hudson payday loans very bad credit (1)

- Clinton online installment loans (1)

- Clover-Link-Oyunları-Türkiyede-Popüler-Kumar-Oyunu.html (1)

- Comment commander par la poste une mariГ©e (1)

- Comment commander une mariГ©e par correspondance russe (1)

- Comment faire une mariГ©e par correspondance (1)

- Comment fonctionne une mariГ©e par correspondance (2)

- Comment fonctionnent la mariГ©e par courrier (1)

- Comment fonctionnent les sites de mariГ©e par courrier (1)

- content1 (2)

- content2 (2)

- correo de la novia orden (1)

- correo en orden novia (1)

- correo orden novia legГtima (1)

- correo orden novia wiki (1)

- correo orden sitios web de novias reddit (1)

- Cortez installment loans near me (1)

- courrier des commandes de la mariГ©e (1)

- Cryptocurrency exchange (2)

- cГіmo enviar por correo a una novia (1)

- Dato (17)

- deberГa salir con una novia por correo (1)

- Dede-Casino-Kumar-Oyunları-Gates-of-Olympus-ile-Yükselişe-Geçin.html (1)

- devrais-je sortir avec une mariГ©e par correspondance (1)

- donde compro una orden de correo novia (1)

- Durchschnittspreis fГјr eine Versandbestellbraut (1)

- Działanie Olejku Cbd I Jego Wpływ Na Organizm – 984 (1)

- e-mail order bride (2)

- easiest payday loans no credit check (1)

- EGT-Slot-Oyunları-Heyecan-Verici-Bir-Dünya-Keşfedin.html (1)

- egt-slot-siteleri (1)

- elitecashadvance.com+installment-loans-ak+central bad credit loans no payday (1)

- elitecashadvance.com+installment-loans-al+riverside how much can you get on a payday loan (1)

- elitecashadvance.com+installment-loans-ar+augusta get cash advance at bank (1)

- elitecashadvance.com+installment-loans-ar+jacksonville get cash advance at bank (1)

- elitecashadvance.com+installment-loans-ar+jacksonville get cash advance payday loans (1)

- elitecashadvance.com+installment-loans-ar+magnolia how to do a cash advance (1)

- elitecashadvance.com+installment-loans-az+san-jose payday loan no credit check lender (1)

- elitecashadvance.com+installment-loans-ca+london get cash advance at bank (1)

- elitecashadvance.com+installment-loans-co+eagle bad credit no credit check payday loans (1)

- elitecashadvance.com+installment-loans-fl+windsor my payday loan (2)

- elitecashadvance.com+installment-loans-ga+cleveland payday loans very bad credit (1)

- elitecashadvance.com+installment-loans-ia+hamilton how to do a payday loan (1)

- elitecashadvance.com+installment-loans-il+hammond no credit check loan payday (1)

- elitecashadvance.com+installment-loans-il+oakwood bad credit no credit check payday loans (1)

- elitecashadvance.com+installment-loans-in+hudson how much interest on a cash advance (1)

- elitecashadvance.com+installment-loans-ky+edmonton how much can you get on a payday loan (1)

- elitecashadvance.com+installment-loans-ky+sacramento get cash advance at bank (1)

- elitecashadvance.com+installment-loans-la+bossier-city payday loan no credit check lender (1)

- elitecashadvance.com+installment-loans-la+central no credit check loan payday (1)

- elitecashadvance.com+installment-loans-la+spokane how to do a payday loan (1)

- elitecashadvance.com+installment-loans-ma+lawrence payday loans very bad credit (1)

- elitecashadvance.com+installment-loans-mn+columbus how to do a payday loan (1)

- elitecashadvance.com+installment-loans-mo+miami how to do a payday loan (1)

- elitecashadvance.com+installment-loans-mt+augusta get cash advance payday loans (1)

- elitecashadvance.com+installment-loans-nc+hamilton payday loans very bad credit (1)

- elitecashadvance.com+installment-loans-nd+surrey no credit check loan payday (1)

- elitecashadvance.com+installment-loans-ne+emerald payday loans very bad credit (1)

- elitecashadvance.com+installment-loans-ne+oakland payday loan no credit check lender (1)

- elitecashadvance.com+installment-loans-nj+magnolia no credit check loan payday (1)

- elitecashadvance.com+installment-loans-nm+san-antonio how much interest on a cash advance (1)

- elitecashadvance.com+installment-loans-nv+reno payday loan no credit check lender (1)

- elitecashadvance.com+installment-loans-oh+birmingham nearby payday loans (1)

- elitecashadvance.com+installment-loans-oh+magnolia get cash advance payday loans (1)

- elitecashadvance.com+installment-loans-oh+reno get cash advance payday loans (1)

- elitecashadvance.com+installment-loans-pa+eagle how to do a payday loan (1)

- elitecashadvance.com+installment-loans-tn+cleveland nearby payday loans (1)

- elitecashadvance.com+installment-loans-tx+columbus how to do a payday loan (1)

- elitecashadvance.com+installment-loans-tx+los-angeles no credit check loan payday (1)

- elitecashadvance.com+installment-loans-tx+san-diego get cash advance at bank (1)

- elitecashadvance.com+installment-loans-ut+delta how to do a payday loan (1)

- elitecashadvance.com+installment-loans-va+alberta nearby payday loans (1)

- elitecashadvance.com+installment-loans-va+richmond how to do a cash advance (1)

- elitecashadvance.com+installment-loans-va+windsor my payday loan (1)

- elitecashadvance.com+installment-loans-wa+hamilton how to do a payday loan (1)

- elitecashadvance.com+payday-loans-ca+bakersfield get cash advance at bank (1)

- elitecashadvance.com+payday-loans-ca+long-beach bad credit no credit check payday loans (1)

- elitecashadvance.com+payday-loans-ca+ontario how much interest on a cash advance (1)

- elitecashadvance.com+payday-loans-co+hudson how to do a payday loan (1)

- elitecashadvance.com+payday-loans-co+windsor how to do a payday loan (1)

- elitecashadvance.com+payday-loans-de+houston cash advance loans with no credit check (1)

- elitecashadvance.com+payday-loans-de+magnolia get cash advance at bank (1)

- elitecashadvance.com+payday-loans-ga+jacksonville how much can you get on a payday loan (1)

- elitecashadvance.com+payday-loans-ia+birmingham nearby payday loans (1)

- elitecashadvance.com+payday-loans-il+atlanta how to do a cash advance (1)

- elitecashadvance.com+payday-loans-il+atlanta nearby payday loans (1)

- elitecashadvance.com+payday-loans-il+el-paso how much interest on a cash advance (1)

- elitecashadvance.com+payday-loans-il+hammond payday loans very bad credit (1)

- elitecashadvance.com+payday-loans-il+kingston no credit check loan payday (1)

- elitecashadvance.com+payday-loans-il+modesto payday loans very bad credit (1)

- elitecashadvance.com+payday-loans-il+ottawa no credit check loan payday (1)

- elitecashadvance.com+payday-loans-in+denver get cash advance at bank (1)

- elitecashadvance.com+personal-loans-mo+birmingham payday loan no credit check lender (1)

- elitecashadvance.com+personal-loans-mt+hamilton cash advance loans with no credit check (1)

- elitecashadvance.com+personal-loans-nd+hamilton payday loans very bad credit (1)

- elitecashadvance.com+personal-loans-nm+columbus no credit check loan payday (1)

- elitecashadvance.com+personal-loans-nv+kingston how much interest on a cash advance (1)

- elitecashadvance.com+personal-loans-oh+nashville how to do a cash advance (1)

- elitecashadvance.com+personal-loans-pa+houston how to do a cash advance (1)

- elitecashadvance.com+personal-loans-tx+combine how to do a payday loan (1)

- elitecashadvance.com+personal-loans-tx+richmond bad credit no credit check payday loans (1)

- elitecashadvance.com+personal-loans-tx+tyler nearby payday loans (1)

- elitecashadvance.com+personal-loans-wi+cleveland get cash advance at bank (1)

- elitecashadvance.com+personal-loans-wi+hudson payday loan no credit check lender (1)

- elitecashadvance.com+personal-loans-wi+ontario how to do a payday loan (1)

- En-İyi-Para-Kazandıran-Kumar-Siteleri-2024(12).html (1)

- En-İyi-The-Dog-House-Slot-Siteleri—Kazançlı-Oyunlar.html (1)

- En-Kazanılabilir-Slot-Oyunları-Şansınızı-Artıracak-İpuçları.html (1)

- essay buying for cheap (1)

- Examen Du Programme D'affiliation Mostbet Partners 2024 : Inscrivez-vous Maintenant ! – 577 (4)

- fast payday loan company (1)

- fast payday loans company (1)

- find a bride (2)

- find a mail order bride (1)

- find me a mail order bride (1)

- find payday loan no credit check (1)

- finding a mail order bride (2)

- FinTech (14)

- first time payday loan no credit check (1)

- Fondamental Best Paypal Fondamental Uk Casinos Accepting Paypal Dépassé 2024 – 889 (1)

- for adults (1)

- Forex Trading (4)

- free (1)

- free online sites for singles (1)

- free site (2)

- gates-of-olympus-kredi-nedir-2024 (1)

- Gates-of-Olympus-Slot-Şansınızı-Deneyin-Dede-Casinoda-Efsanevi-Ödüller-Kazanın.html (1)

- get a cash advance (1)

- get a cash advance with bad credit (1)

- get a payday loan advance (1)

- get a payday loan near me (1)

- get a payday loan no interest (2)

- get a payday loan now bad credit (3)

- get advance cash now (2)

- get cash advance (1)

- get cash advance at bank (2)

- get cash advance loans (1)

- get cash advance payday loans (3)

- get cash payday loan (1)

- get cash payday loan loan (1)

- get me a payday loan (1)

- get payday cash advance (2)

- get payday loan bad credit (1)

- get payday loan no interest (1)

- get payday loan with bad credit (1)

- Get-Hooked-Without-the-Risk-Exploring-the-World-of-Demo-Slots.html (1)

- getting a payday loan (1)

- getting a payday loan with bad credit (2)

- getting cash advance (1)

- getting payday loan (1)

- good mail order bride sites (1)

- good payday loans no credit check (1)

- guide to payday loans (1)

- Hallettsville installment loans near me (1)

- hayatnotlari.com_may (1)

- hello (1)

- help write my essay for me (1)

- help write my essay today (1)

- historias de novias de pedidos por correo (1)

- history of mail order bride (1)

- how can i get a cash advance (1)

- how can i get a payday loan (1)

- how can i get cash advance (2)

- how cash advance works (2)

- how do cash advance loans work (1)

- how do i do cash advance (2)

- how do i get a cash advance (1)

- how do i get a payday loan with bad credit (1)

- how do i get a payday loans (1)

- how do mail order bride sites work (1)

- how do payday loans (2)

- how do payday loans works (1)

- how do payday loans works with no credit (1)

- how do you do a cash advance (1)

- how do you do cash advance (1)

- how do you get a payday loan? (1)

- how does a payday cash advance work (1)

- how does cash advance loans work (1)

- how does cash advance work (1)

- how does cash in advance work (1)

- how does payday loan (1)

- how does payday loan work (1)

- how does payday loans work (1)

- how does the cash advance work (1)

- how i can get advance cash (1)

- how much can you get for a payday loan (1)

- how much can you get from a cash advance (1)

- how much can you get from a payday loan (1)

- how much can you get from payday loans (1)

- how much can you get on a payday loan (1)

- how much can you get with a payday loan (1)

- how much cash advance (2)

- how much cash advance can i get (1)

- how much could i get on a payday loan (1)

- how much do you get for payday loan (1)

- how much interest cash advance (1)

- how much interest do you pay on a cash advance (1)

- how much interest for cash advance (2)

- how much interest on a payday loan (1)

- how much is a cash advance (1)

- how much is a cash advance from advance america (1)

- how much is a payday loan for (1)

- how much is interest on cash advance (1)

- how much is my cash advance interest (1)

- how much is the interest on payday loans (1)

- how much payday loan can i get (3)

- how much to pay for payday loans (2)

- how payday loan work (2)

- how payday loan works (2)

- how payday loans work in usa (3)

- how soon do i have to pay payday loans (1)

- how to cash advance (1)

- how to do a cash advance (1)

- how to do a mail order bride (2)

- how to do cash advance (3)

- how to do cash advance at bank (1)

- how to do payday loan (2)

- how to get a cash advance (1)

- how to get a cash advance from payday (1)

- how to get a cash advance loan (1)

- how to get a cash advance with bad credit (1)

- how to get a loan from cash advance (1)

- how to get a payday loan bad credit (2)

- how to get a payday loan near me (1)

- how to get a payday loan with bad credit? (1)

- how to get a payday loan with no credit check (2)

- how to get american cash advance (1)

- how to get cash advance (1)

- how to get cash advance out of your credit (2)

- how to get payday loan with bad credit (1)

- how to get payday loans (1)

- how to get you payday loan (1)

- how to order a russian mail order bride (2)

- how to order mail order bride (1)

- how to payday loan (1)

- how to payday loans work (1)

- how to prepare a mail order bride reddit (1)

- how to use cash advance (1)

- how to use payday loans (2)

- i need a payday loan bad credit (2)

- i need a payday loan but i have bad credit (1)

- i need a payday loan now with bad credit (1)

- i need a payday loans (1)

- i need cash advance (1)

- i want a mail order bride (2)

- installmentloansvirginia (2) online installment loans instant approval (1)

- installmentloansvirginia bad credit installment loans (1)

- instant no credit check payday loans (1)

- instant payday loans direct lender no credit check (1)

- instant payday loans no credit check (2)

- international mail order bride (1)

- interracial mail order bride (2)

- is a cash advance bad (1)

- is mail order bride a real thing (1)

- Ist Versandbestellbraut es wert? (1)

- IT Education (1)

- IT Вакансії (1)

- IT Образование (4)

- IT Освіта (1)

- İyzico-Wallet-Kabul-Eden-En-İyi-Casino-Siteleri(3).html (1)

- İdman Mərcləri Və Onlayn Kazino 500 Bonus Qazanın Giriş – 632 (1)

- japanese mail order bride (1)

- Jefferson City online installment loans instant approval (1)

- jglhl (1)

- Kansas installment loans near me (1)

- Kazandırma-Saatleri-Slot-Oyunlarında-Başarı-İçin-Bilinmesi-Gerekenler.html (1)

- Kazandırmanın-Zamanlaması-Sweet-Bonanza-Saatlerinde-Yüksek-Kazanç-İmkanları.html (1)

- Kenner guaranteed installment loans for bad credit (1)

- Kentucky installment loans near me (1)

- latin brides (1)

- latin dating (1)

- leggit mail order bride sites (1)

- legit mail order bride sites (2)

- legit no credit check payday loan (1)

- legit no credit check payday loans (2)

- legit payday loan no credit check (1)

- legit payday loans no credit check (1)

- legit payday loans with no credit check (1)

- legitimate mail order bride (1)

- legitimate mail order bride companies (1)

- legitimate mail order bride services (1)

- legitimate mail order bride sites (1)

- legitimate mail order bride website (1)

- legitime Mail -Bestellung Braut Site (1)

- Legitime Mail bestellen Brautwebsite (1)

- lesbian mail order bride (2)

- Lesbienne Mail Commande Bride Reddit (1)

- Liste der besten Mail -Bestell -Braut -Sites (1)

- loan cash advance (1)

- loan company fast cash payday loan (2)

- loan for bad credit not payday loan (4)

- loan for cash advance (1)

- loan me payday loan (2)

- loan no payday (1)

- loan payday (1)

- loan payday loans (1)

- loan payday loans near me (3)

- loan to pay payday loan (1)

- loan to payday (1)

- loans and cash advance (1)

- loans for bad credit not payday loans (2)

- loans for bad credit payday loans (1)

- loans for payday (1)

- loans not payday (1)

- loans not payday for bad credit (1)

- loans not payday loans (1)

- loans payday cash advance (2)

- loans payday loan (2)

- loans payday loans (1)

- loans unlimited cash advance (1)

- loans with no credit check no payday loans (2)

- looking for a payday loan with bad credit (1)

- Lotoclub (2)

- Louisville installment loans online (1)

- low interest payday loans no credit check (1)

- Macon guaranteed installment loans for bad credit direct lenders only (1)

- Mail -Bestellung Braut Datierung (1)

- Mail -Bestellung Brautagenturen (1)

- Mail -Bestellung Brautdienste (1)

- Mail -Bestellung Brautdienste Definition (1)

- Mail -Bestellung Brautkatalog (1)

- Mail -Bestellung Brautservice (2)

- Mail -Bestellung Bride Agency Reviews (1)

- Mail bestellen Braut Arbeit? (1)

- Mail bestellen Braut Wikipedia (2)

- Mail bestellen Brautartikel (1)

- Mail bestellen Brautstandorte legitim (2)

- Mail bestellen Brautwebsites (1)

- mail bride order (2)

- Mail dans l'ordre de la mariГ©e (1)

- Mail dans la dГ©finition de la mariГ©e (1)

- mail in order bride (1)

- mail in order bride definition (1)

- mail on order bride (2)

- mail order a bride (1)

- mail order bride (1)

- mail order bride articles (1)

- mail order bride catalog (4)

- mail order bride countries (1)

- mail order bride define (1)

- mail order bride industry (2)

- mail order bride legit (1)

- mail order bride real (1)

- mail order bride real site (2)

- mail order bride reveiw (1)

- mail order bride review (2)

- mail order bride services (1)

- mail order bride services definition (1)

- mail order bride sites reddit (1)

- mail order bride stories reddit (1)

- mail order bride story (1)

- mail order bride website (1)

- mail order bride website reviews (2)

- mail order bride websites reddit (1)

- mail order bride websites reviews (1)

- mail order wife (2)

- mail to order bride (2)

- Mail. Bride Legit (1)

- Mailbrautbestellung (1)

- Maine installment loans near me (1)

- Maine online installment loans instant approval (1)

- Mansura online installment loans (1)

- Meilleure mariГ©e par correspondance de tous les temps (1)

- Meilleurs sites Web de mariГ©es par correspondance reddit (2)

- mejor sitio web de la novia por correo (1)

- mejores empresas de novias por correo (3)

- mejores lugares para recibir pedidos por correo novia (1)

- mejores sitios para novias por correo (1)

- Meritkingte-Kayt-Aşamasında-Dikkat-Edilmesi-Gerekenler.html (1)

- Missouri installment loans near me (1)

- Monterey online installment loans (1)

- Mostbet App Ke Stažení Aplikace Pro Ios A Android Apk – 256 (4)

- Mostbet AZ Casino (2)

- Mostbet Bookie: Nejlepší Kurzy A Online Sázení Online – 761 (4)

- Mostbet Kaszinó Online Hivatalos Oldal Mostbet Casino Hungary Nyerőgépek, Bónuszok, Bejelentkezés – 385 (5)

- Mostbet Online Kaszinó, Fogadótársaság » Bejelentkezés És Fogadás – 377 (5)

- Mostbet Partners Affiliate Marketing Forum – 756 (2)

- Mostbet Russia (1)

- mostbet tr (1)

- Mostbet UZ Casino Online (1)

- Mostbet UZ Kirish (1)

- Mostbet Uzbekistan Официальный Сайт Спортивных Ставок И Онлайн-казино Uz 2023 – 2 (4)

- MostBet Ваш Самый Прибыльный партнер в мире Ставок Букмекеры в Ереване ДжекпотИк – 528 (4)

- my cash advance (1)

- my payday loan (1)

- Najbolje narudЕѕbe mladenke (1)

- NaruДЌivanje poЕЎte mladenke (1)

- nearby cash advance (1)

- nearest payday loans from here (4)

- need a payday advance loan now bad credit (1)

- need a payday loan now (1)

- need a payday loan or cash advance (1)

- need a payday loans (1)

- need a payday loans or cash advance no credit check (1)

- need cash advance bad credit (1)

- need cash no payday loans (1)

- need payday loan now (1)

- need to be a member cash advance (2)

- NetEnt-Slot-Oyunlarıyla-Dolu-Bir-Gece-En-İyi-Kasino-Seçenekleri.html (1)

- new cash advance (1)

- new cash advance loans (1)

- New Lexington installment loans for bad credit (1)

- new payday loans no credit check (1)

- new year payday loan (1)

- new year payday loans (1)

- New York online installment loans instant approval (1)

- news (296)

- next payday loan for bad credit no credit check (2)

- no credit check advance payday loans (1)

- no credit check cash advance loans (3)

- no credit check direct deposit payday loans (1)

- no credit check direct lenders payday loans (1)

- no credit check instant cash advance (2)

- no credit check instant payday loans (1)

- no credit check loan payday (1)

- no credit check loans payday (1)

- no credit check no bank account payday loans (2)

- no credit check non payday loan (1)

- no credit check payday loan company (1)

- no credit check payday loan direct lenders only (1)

- no credit check payday loan lender (1)

- no credit check payday loan lenders (1)

- no credit check payday loan near me (1)

- no credit check payday loans lenders only (1)

- no credit check payday loans near me (1)

- no credit check payday loans on line (1)

- no credit check payday low intrest loan (2)

- nursing (1)

- Online -Mail -Bestellung Braut (1)

- only consumer reports (1)

- or payday loans (1)

- orden de correo de la industria de la novia (1)

- orden de correo novia de verdad (1)

- orden de correo novia definir (1)

- order cheap essay online (1)

- order custom essay cheap (1)

- Ordway online installment loans (1)

- OГ№ puis-je acheter une mariГ©e par correspondance (1)

- paras maa löytää postimyynti morsiamen (1)

- parhaiten arvioidut postimyynti morsiamen sivustot (1)

- pay cash advance loans (1)

- pay for an essay online (1)

- pay for essay paper (2)

- pay payday loans (2)

- pay someone to write an essay for you (1)

- payday advance cash loans (1)

- payday advance loan (1)

- payday advance loan near me (1)

- payday advance loan no credit check (1)

- payday advance loans bad (2)

- payday advance loans bad credit (1)

- payday advance loans for bad credit (1)

- payday advance loans near me (1)

- payday advance loans no credit check (2)

- payday advances loans (2)

- payday advances or payday loans (1)

- payday america loan (1)

- payday american loans (1)

- payday and loan (1)

- payday bad credit loan (1)

- payday bad credit loans (1)

- payday cash advance loan bad credit (1)

- payday cash advance loans no credit check (1)

- payday cash loans bad credit (2)

- payday cash loans with bad credit (1)

- payday loan advance (1)

- payday loan advance america (2)

- payday loan advances (1)

- payday loan agency no credit check (2)

- payday loan and cash advance (2)

- payday loan bad (1)

- payday loan bad credit no credit check near me (2)

- payday loan cash (2)

- payday loan cash now (2)

- payday loan company definition (1)

- payday loan company near me (1)

- payday loan creator (1)

- payday loan def (1)

- payday loan for (1)

- payday loan for bad credit (1)

- payday loan for very bad credit (1)

- payday loan in (1)

- payday loan in advance (2)

- payday loan in america (3)

- payday loan in usa (1)

- payday loan instant funding no credit check (1)

- payday loan is (1)

- payday loan lender only no credit check (1)

- payday loan lenders no credit check (1)

- payday loan near me bad credit (1)

- payday loan near me no credit check (1)

- payday loan near me no interest (1)

- payday loan need now (1)

- payday loan needed (1)

- payday loan no broker no credit check (3)

- payday loan no credit check direct lenders (1)

- payday loan no credit check instant (1)

- payday loan no credit check instant payout (2)

- payday loan no credit check lender (1)

- payday loan no credit check no bank account (1)

- payday loan no credit check no checking account (1)

- payday loan no creditcheck (1)

- payday loan no interest (2)

- payday loan on (1)

- payday loan organization no credit check (1)

- payday loan payday loan near me (1)

- payday loan payday loans (1)

- payday loan what do i need (1)

- payday loan what is (2)

- payday loan what is payday loan (1)

- payday loan with bad credit (1)

- payday loan with bad credit near me (1)

- payday loan with no credit (2)

- payday loan with no credit check or bank account (3)

- payday loan with very bad credit (3)

- payday loans america (1)

- payday loans and cash advance (1)

- payday loans and interest (1)

- payday loans are bad (1)

- payday loans as (2)

- payday loans bad credit loans and cash advance loans (3)

- payday loans bad credit near me (2)

- payday loans bad credit no credit check (1)

- payday loans bad credit no credit check direct lender (1)

- payday loans bad for credit (1)

- payday loans cash advance (1)

- payday loans cash advance no credit check (1)

- payday loans cash loans (1)

- payday loans cash now (1)

- payday loans com (1)

- payday loans company near me (1)

- payday loans direct no credit check (1)

- payday loans for anyone (1)

- payday loans for bad credit direct lender no credit check (1)

- payday loans for bad credit loans (1)

- payday loans for no credit check (1)

- payday loans for very bad credit (1)

- payday loans forbad credit (1)

- payday loans how much interest (1)

- payday loans how they work (1)

- payday loans how to (1)

- payday loans info (1)

- payday loans lenders near me no credit check (2)

- payday loans lenders no credit check (1)

- payday loans near (1)

- payday loans near me (2)

- payday loans near me no credit (1)

- payday loans near me no credit check no bank account (1)

- payday loans near me now (1)

- payday loans near me with no credit check (1)

- payday loans neat me (1)

- payday loans new (1)

- payday loans new me (1)

- payday loans no (2)

- payday loans no bank account no credit check (1)

- payday loans no bank account no credit check near me (2)

- payday loans no brokers no credit check (1)

- payday loans no credit check direct deposit (3)

- payday loans no credit check direct lender (2)

- payday loans no credit check direct lenders only (1)

- payday loans no credit check lender (1)

- payday loans no credit check lenders (1)

- payday loans no credit check low interest (2)

- payday loans no credit check no checking account (1)

- payday loans no credit check no lenders (1)

- payday loans no credit check places (1)

- payday loans no hard credit check (1)

- payday loans now (1)

- payday loans of america (2)

- payday loans on (1)

- payday loans places near me no credit check (1)

- payday loans tomorrow (1)

- payday loans use passport (1)

- payday loans very bad credit (1)

- payday loans what are (2)

- payday loans what do you need (1)

- payday loans what is (1)

- payday loans with bad credit (1)

- payday loans with bad credit no credit check (3)

- payday loans with no credit check (1)

- payday loans with no credit check direct lender (1)

- payday loans with no credit check or bank account (1)

- payday loans with no credit check or checking account (1)

- payday loans\ (2)

- payday no credit check loans (1)

- payday now loans (1)

- payday or cash advance loans (2)

- paydayloanalabama.com+abanda get cash advance at bank (1)

- paydayloanalabama.com+albertville no credit check loan payday (1)

- paydayloanalabama.com+alexandria bad credit no credit check payday loans (1)

- paydayloanalabama.com+altoona cash to go and advance america (1)

- paydayloanalabama.com+anderson payday loan instant funding no credit check (1)

- paydayloanalabama.com+arley get cash advance at bank (1)

- paydayloanalabama.com+ashland payday loan instant funding no credit check (1)

- paydayloanalabama.com+athens get cash advance at bank (1)

- paydayloanalabama.com+attalla cash to go and advance america (1)

- paydayloanalabama.com+avon cash to go and advance america (1)

- paydayloanalabama.com+babbie my payday loan (1)

- paydayloanalabama.com+baileyton how much can you get on a payday loan (1)

- paydayloanalabama.com+bay-minette no credit check loan payday (1)

- paydayloanalabama.com+bear-creek my payday loan (1)

- paydayloanalabama.com+belk cash advance loans with no credit check (1)

- paydayloanalabama.com+bellamy cash to go and advance america (1)

- paydayloanalabama.com+bessemer bad credit no credit check payday loans (1)

- paydayloanalabama.com+billingsley payday loan instant funding no credit check (1)

- paydayloanalabama.com+blue-springs cash to go and advance america (1)

- paydayloanalabama.com+boligee nearby payday loans (1)

- paydayloanalabama.com+bon-air get cash advance at bank (1)

- paydayloanalabama.com+brantleyville my payday loan (1)

- paydayloanalabama.com+brent bad credit no credit check payday loans (1)

- paydayloanalabama.com+camp-hill get a cash advance (1)

- paydayloanalabama.com+cardiff get a cash advance (1)

- paydayloanalabama.com+castleberry cash advance loans with no credit check (1)

- paydayloanalabama.com+centre nearby payday loans (1)

- paydayloanalabama.com+chatom no credit check loan payday (1)

- paydayloanalabama.com+choccolocco payday loan instant funding no credit check (1)

- paydayloanalabama.com+chunchula payday loan instant funding no credit check (1)

- paydayloanalabama.com+clayhatchee cash to go and advance america (1)

- paydayloanalabama.com+cleveland payday loan instant funding no credit check (1)

- paydayloanalabama.com+clio how much can you get on a payday loan (1)

- paydayloanalabama.com+coaling get a cash advance (1)

- paydayloanalabama.com+coffee-springs no credit check loan payday (1)

- paydayloanalabama.com+colony cash advance loans with no credit check (1)

- paydayloanalabama.com+columbiana payday loan instant funding no credit check (1)

- paydayloanalabama.com+cottondale my payday loan (1)

- paydayloanalabama.com+cottonwood get a cash advance (1)

- paydayloanalabama.com+cowarts how much can you get on a payday loan (1)

- paydayloanalabama.com+cullomburg how much can you get on a payday loan (1)

- paydayloanalabama.com+dadeville how much can you get on a payday loan (1)

- paydayloanalabama.com+decatur cash to go and advance america (1)

- paydayloanalabama.com+deer-park get cash advance at bank (2)

- paydayloanalabama.com+delta get cash advance at bank (1)

- paydayloanalabama.com+demopolis my payday loan (1)

- paydayloanalabama.com+detroit get cash advance at bank (1)

- paydayloanalabama.com+dothan get a cash advance (1)

- paydayloanalabama.com+douglas cash to go and advance america (1)

- paydayloanalabama.com+dozier get a cash advance (1)

- paydayloanalabama.com+dutton how much can you get on a payday loan (1)

- paydayloanalabama.com+east-point my payday loan (1)

- paydayloanalabama.com+eclectic no credit check loan payday (1)

- paydayloanalabama.com+edwardsville my payday loan (1)

- paydayloanalabama.com+eldridge no credit check loan payday (1)

- paydayloanalabama.com+elkmont bad credit no credit check payday loans (1)

- paydayloanalabama.com+elmore nearby payday loans (1)

- paydayloanalabama.com+enterprise get a cash advance (1)

- paydayloanalabama.com+eunola my payday loan (1)

- paydayloanalabama.com+excel how much can you get on a payday loan (1)

- paydayloanalabama.com+fairview get a cash advance (1)

- paydayloanalabama.com+falkville nearby payday loans (1)

- paydayloanalabama.com+faunsdale how much can you get on a payday loan (1)

- paydayloanalabama.com+fort-deposit nearby payday loans (1)

- paydayloanalabama.com+garden-city get cash advance at bank (1)

- paydayloanalabama.com+geiger my payday loan (1)

- paydayloanalabama.com+georgiana bad credit no credit check payday loans (1)

- paydayloanalabama.com+gilbertown bad credit no credit check payday loans (1)

- paydayloanalabama.com+glen-allen get cash advance at bank (1)

- paydayloanalabama.com+good-hope get a cash advance (1)

- paydayloanalabama.com+gordon bad credit no credit check payday loans (1)

- paydayloanalabama.com+graham how much can you get on a payday loan (1)

- paydayloanalabama.com+grant get a cash advance (1)

- paydayloanalabama.com+grimes cash advance loans with no credit check (1)

- paydayloanalabama.com+grove-hill my payday loan (1)

- paydayloanalabama.com+gurley cash to go and advance america (1)

- paydayloanalabama.com+harpersville get a cash advance (1)

- paydayloanalabama.com+hartford get a cash advance (1)

- paydayloanalabama.com+hayden get a cash advance (1)

- paydayloanalabama.com+hazel-green get a cash advance (1)

- paydayloanalabama.com+helena get a cash advance (1)

- paydayloanalabama.com+henagar my payday loan (1)

- paydayloanalabama.com+highland-lakes get a cash advance (1)

- paydayloanalabama.com+hobson payday loan instant funding no credit check (1)

- paydayloanalabama.com+hobson-city cash advance loans with no credit check (1)

- paydayloanalabama.com+hollywood payday loan instant funding no credit check (1)

- paydayloanalabama.com+holt payday loan instant funding no credit check (1)

- paydayloanalabama.com+homewood nearby payday loans (1)

- paydayloanalabama.com+hoover get a cash advance (1)

- paydayloanalabama.com+hueytown cash to go and advance america (1)

- paydayloanalabama.com+ider no credit check loan payday (1)

- paydayloanalabama.com+jasper no credit check loan payday (1)

- paydayloanalabama.com+kennedy cash to go and advance america (1)

- paydayloanalabama.com+killen bad credit no credit check payday loans (1)

- paydayloanalabama.com+leesburg get cash advance at bank (1)

- paydayloanalabama.com+lookout-mountain how much can you get on a payday loan (1)

- paydayloanalabama.com+lowndesboro no credit check loan payday (1)

- paydayloanalabama.com+luverne cash advance loans with no credit check (1)

- paydayloanalabama.com+magnolia-springs cash advance loans with no credit check (1)

- paydayloanalabama.com+malvern how much can you get on a payday loan (1)

- paydayloanalabama.com+mccalla get a cash advance (1)

- paydayloanalabama.com+meadowbrook cash advance loans with no credit check (1)

- paydayloanalabama.com+megargel cash advance loans with no credit check (1)

- paydayloanalabama.com+mentone cash advance loans with no credit check (1)

- paydayloanalabama.com+millerville payday loan instant funding no credit check (1)

- paydayloanalabama.com+millport how much can you get on a payday loan (1)

- paydayloanalabama.com+mobile get cash advance at bank (1)

- paydayloanalabama.com+montgomery cash to go and advance america (2)

- paydayloanalabama.com+mooresville cash advance loans with no credit check (1)

- paydayloanalabama.com+mount-vernon no credit check loan payday (1)

- paydayloanalabama.com+movico get a cash advance (1)

- paydayloanalabama.com+mulga bad credit no credit check payday loans (1)

- paydayloanalabama.com+nances-creek cash to go and advance america (2)

- paydayloanalabama.com+new-site my payday loan (1)

- paydayloanalabama.com+new-union payday loan instant funding no credit check (1)

- paydayloanalabama.com+newbern cash advance loans with no credit check (1)

- paydayloanalabama.com+newton my payday loan (1)

- paydayloanalabama.com+newville bad credit no credit check payday loans (1)

- paydayloanalabama.com+northport bad credit no credit check payday loans (2)

- paydayloanalabama.com+odenville get cash advance at bank (1)

- paydayloanalabama.com+ohatchee cash advance loans with no credit check (1)

- paydayloanalabama.com+oneonta payday loan instant funding no credit check (1)

- paydayloanalabama.com+opelika my payday loan (1)

- paydayloanalabama.com+owens-cross-roads cash advance loans with no credit check (1)

- paydayloanalabama.com+oxford cash to go and advance america (2)

- paydayloanalabama.com+ozark payday loan instant funding no credit check (1)

- paydayloanalabama.com+paint-rock get a cash advance (1)

- paydayloanalabama.com+panola cash to go and advance america (2)

- paydayloanalabama.com+phenix-city cash advance loans with no credit check (2)

- paydayloanalabama.com+pinckard nearby payday loans (1)

- paydayloanalabama.com+pine-level payday loan instant funding no credit check (1)

- paydayloanalabama.com+pleasant-groves get a cash advance (1)

- paydayloanalabama.com+point-clear bad credit no credit check payday loans (1)

- paydayloanalabama.com+pollard cash to go and advance america (2)

- paydayloanalabama.com+powell bad credit no credit check payday loans (1)

- paydayloanalabama.com+prichard cash to go and advance america (2)

- paydayloanalabama.com+ragland get a cash advance (1)

- paydayloanalabama.com+rainbow-city no credit check loan payday (1)

- paydayloanalabama.com+red-level cash to go and advance america (2)

- paydayloanalabama.com+riverside cash to go and advance america (2)

- paydayloanalabama.com+roanoke cash advance loans with no credit check (1)

- paydayloanalabama.com+rogersville get a cash advance (1)

- paydayloanalabama.com+saraland no credit check loan payday (2)

- paydayloanalabama.com+satsuma get a cash advance (1)

- paydayloanalabama.com+section how much can you get on a payday loan (1)

- paydayloanalabama.com+shiloh bad credit no credit check payday loans (1)

- paydayloanalabama.com+shorter get a cash advance (1)

- paydayloanalabama.com+skyline get a cash advance (1)

- paydayloanalabama.com+smiths-station no credit check loan payday (1)

- paydayloanalabama.com+snead cash to go and advance america (2)

- paydayloanalabama.com+south-vinemont get a cash advance (1)

- paydayloanalabama.com+spring-garden cash to go and advance america (2)

- paydayloanalabama.com+springville get cash advance at bank (1)

- paydayloanalabama.com+st-florian get a cash advance (1)

- paydayloanalabama.com+stapleton my payday loan (1)

- paydayloanalabama.com+sterrett payday loan instant funding no credit check (1)

- paydayloanalabama.com+susan-moore get a cash advance (1)

- paydayloanalabama.com+sweet-water no credit check loan payday (1)

- paydayloanalabama.com+sylacauga payday loan instant funding no credit check (1)

- paydayloanalabama.com+taylor get a cash advance (1)

- paydayloanalabama.com+tibbie payday loan instant funding no credit check (1)

- paydayloanalabama.com+trinity cash advance loans with no credit check (1)

- paydayloanalabama.com+troy bad credit no credit check payday loans (1)

- paydayloanalabama.com+tuscaloosa get a cash advance (1)

- paydayloanalabama.com+union-springs my payday loan (1)

- paydayloanalabama.com+valley-head cash to go and advance america (1)

- paydayloanalabama.com+vandiver get a cash advance (1)

- paydayloanalabama.com+vestavia-hills payday loan instant funding no credit check (1)